Utility-scale energy storage deployment has reached an inflection point where hardware flexibility can determine project success or failure. With the U.S. Energy Information Administration projecting a record 18.2 GW of utility-scale battery storage additions in 2025—nearly double the 10.3 GW installed in 2024—developers face unprecedented growth alongside supply chain uncertainties, evolving battery chemistries, and changing grid requirements.[1][2] These market dynamics create numerous critical design decisions that will shape project outcomes, with one of the most fundamental being the choice between integrated and modular system architectures. This architectural decision ultimately determines a project’s ability to adapt to the rapidly scaling market. Integrated systems prioritize simplicity and single-vendor accountability, while modular approaches emphasize technology flexibility and vendor diversification. Neither approach is universally superior; the optimal choice depends on risk tolerance, procurement strategy, and operational expertise.

At Stem, our experience across both integrated and modular deployments has provided insights into how these architectural decisions affect project outcomes. With over 16+ years of experience operating energy storage systems in multiple markets, we’ve observed that architectural decisions impact not just technical performance, but also deployment risk, operational complexity, and long-term adaptability to changing market conditions.

In this edition of Battle of the BESS, we analyze the key project considerations that determine whether an integrated or modular solution is optimal for your project.

What’s the Difference Between Integrated and Modular Solutions?

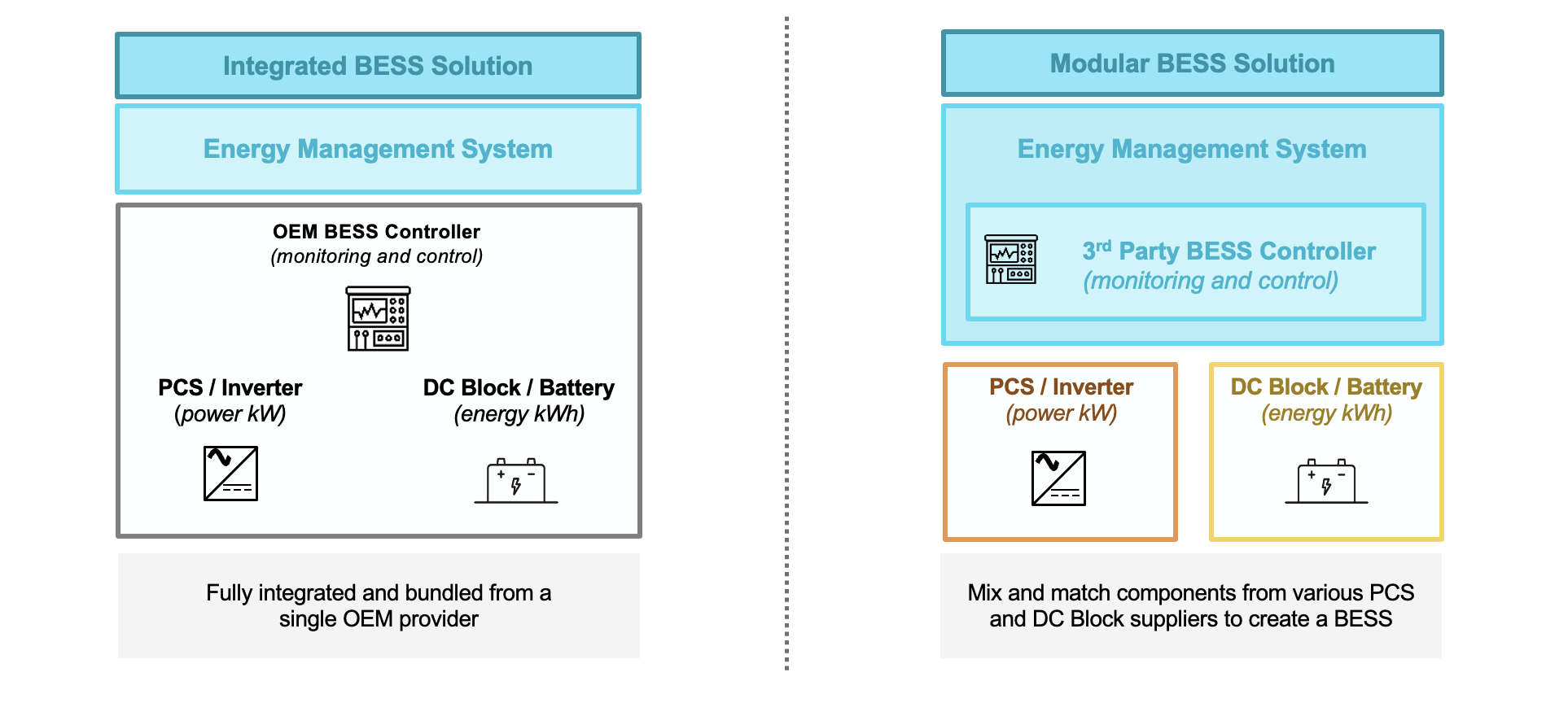

The fundamental distinction between integrated and modular energy storage systems lies in their approach to component organization, vendor relationships, and system flexibility.

Integrated energy storage systems package all critical components—batteries, inverters, and the unit controller—into unified, pre-engineered assemblies from a single vendor. These integrated solutions arrive as complete systems with factory-tested interfaces, standardized configurations, and consolidated warranty coverage. The integration complexity is handled at the manufacturing level, simplifying field deployment and reducing coordination requirements.

Modular energy storage systems allow developers to mix and match components from different vendors to gain an edge for their project. This system involves procuring batteries (or “DC blocks”) and inverters (or the “power conversion system,” or PCS) separately and then partnering with either an OEM or an integrator to provide the BESS controller. This system integrator may also perform integration and site acceptance testing to ensure that different parts of this system work together effectively. While this approach introduces integration complexity, it enables technology flexibility and vendor diversification strategies.

| Consideration | Integrated | Modular |

| Deployment Risk | Lower

|

Higher

|

| Operational Risk | Lower

|

Higher

|

| Supply Chain Risk (FEOC and Tariffs) | Moderately High to High

|

Flexible

|

| Technology Flexibility | Limited Flexibility

|

More Flexibility

|

| Procurement | Lower Complexity

|

Higher Complexity

|

| CapEx/OpEx | Higher CapEx, Lower OpEx

|

Lower CapEx, Variable OpEx

|

Understanding Architecture Risk Profiles

The choice between integrated and modular architectures fundamentally shapes project risk allocation and operational complexity management.

Integrated systems minimize deployment and operational risk through consolidated vendor accountability. When issues arise during commissioning or operation, there’s “one hand to shake” for resolution, eliminating the finger-pointing that can complicate problem-solving in multi-vendor environments. Integration between components is handled by the OEM, making installation easier for EPCs who may lack specialized energy storage experience.

Modular systems require specialized integration expertise but offer significant CapEx savings. Many EPCs lack experience with modular configurations, requiring careful contractor selection and enhanced owner’s engineering oversight. While some of the integration risk may be mitigated with extensive testing, such as Hardware-in-the-Loop (HIL) testing, there may be significant risk associated with any issues that arise onsite and might require coordination between multiple parties. While these deployment risks are real, they can be effectively mitigated by partnering with experienced system integrators and utilizing proven modular architectures with established track records.

Technology Evolution and Flexibility Strategies

The pace of battery technology advancement creates significantly different implications for integrated versus modular architectures, particularly as new chemistries and grid requirements emerge.

Modular systems enable rapid technology adoption. When new technologies like sodium-ion batteries become commercially viable, modular architectures can incorporate new DC block technologies while maintaining existing PCS infrastructure across project portfolios. This approach enables selective technology upgrades, providing substantial competitive advantages as the industry evolves.

Integrated systems face slower technology adoption cycles. If manufacturers start producing advanced battery chemistries but your integrated vendor hasn’t adopted the technology, you’re constrained to wait for their product roadmap. Solution flexibility is limited compared to modular approaches that can independently upgrade components.

Supply Chain Risk Management and Procurement Strategy

Trade policy uncertainties and supply chain disruptions create different risk exposures for integrated versus modular procurement approaches.

Integrated systems could concentrate supply chain risk. Sourcing all equipment from a single vendor can expose projects to significant tariffs and FEOC implications. Recent trade policy developments, including potential duties on Chinese battery materials, demonstrate how concentrated sourcing can create project vulnerabilities.

Modular systems enable supply chain diversification. The choice to select equipment vendors from different countries provides flexibility to diversify risk or eliminate risk on certain components. This approach proves especially valuable during periods of trade policy uncertainty or supply chain disruption.

However, modular procurement adds complexity through managing multiple supply contract negotiations. This complexity can be simplified by working with distributors, like Stem, that represent multiple component manufacturers, providing procurement efficiency while maintaining vendor diversification benefits.

Economic Considerations and Cost Optimization

The cost profiles of integrated versus modular systems reflect their different risk and complexity characteristics, with distinct implications for both capital deployment and ongoing operations.

Integrated systems trade higher CapEx for operational simplicity. While upfront costs are typically higher on integrated offerings, consolidated vendor relationships simplify service delivery and reduce ongoing operational complexity. Single-source accountability eliminates coordination costs and provides predictable maintenance schedules.

Modular systems optimize capital efficiency but require operational expertise. Competitive component procurement typically achieves lower initial capital costs through vendor competition and economies of scale. However, operational success depends on proper deployment risk management and experienced integration partners to avoid cost overruns and performance issues.

Conclusion

Both approaches have their place. The choice between integrated and modular energy storage systems comes down to your risk tolerance, technical expertise, and flexibility priorities.

Opt for integrated systems if you want:

- Lower deployment risk and simpler operations

- Single vendor accountability (“one hand to shake”)

- Faster problem resolution with less coordination

- Streamlined project execution

Opt for modular systems if you want:

- Technology flexibility and vendor diversification

- Cost optimization through competitive procurement

- Ability to perform DC augmentation

Market trends favor flexibility. As battery technology evolves rapidly and trade policies create supply chain uncertainty, modular approaches offer advantages through vendor diversification and technology adaptation. However, this flexibility requires stronger technical capabilities and careful risk management.

The right choice depends on your specific project requirements, organizational capabilities, and long-term strategy. While ESS hardware selection and vendor qualification present complex challenges, choosing the right software and services partner is equally critical. You need a trusted advisor with deep expertise across the complete solution stack to ensure your projects are future-proofed and deliver maximum asset returns.

To explore which configuration best aligns with your risk tolerance and technical capabilities, reach out to us at stem.com.

References

- U.S. Energy Information Administration. (2025). Solar, battery storage to lead new U.S. generating capacity additions in 2025. https://www.eia.gov/todayinenergy/detail.php?id=64586

- BloombergNEF. (2025, May 19). Headwinds in Largest Energy Storage Markets Won’t Deter Growth. https://about.bnef.com/blog/headwinds-in-largest-energy-storage-markets-wont-deter-growth/