Today’s global supply chain has evolved into a highly integrated environment that is now experiencing a disruption like we’ve never seen before. Labor and material shortages are the root cause of the issues, in no small part due to COVID-19, and are adding to the reality of increased inflation, raw materials, and freight fees all around the globe. For the renewable energy sector, the disruption to the global supply chain has had a significant impact on the cost and availability of battery storage hardware. Without the proper partnerships to procure battery storage hardware, these impacts have the potential to delay projects and decrease profit margins for project developers, solar EPCs, IPPs, asset owner partners, and their customers alike.

Collectively, Stem’s supply chain team has over 30 years of experience in the battery storage industry. This blog covers the current state of the global supply chain, the variables that influence the hardware being procured, and the benefits of partnering with Stem to secure battery storage hardware from top-tier OEMs through Stem’s advanced procurement process.

Increased energy storage hardware lead times

Prior to the COVID-19 global pandemic, lead times to procure battery storage hardware hovered anywhere from 16 to 28 weeks depending on the OEM and where the product was being manufactured. However, over the past two years, the industry experienced an increase in lead times ranging from 34 to 42 weeks – almost doubled! – and that is mostly due to the access of raw materials, increased demand in competing markets such as EV, and labor shortages associated with general manufacturing and bringing new production lines online.

Across all markets, significant freight and logistics delays have also been lingering side effects of this pandemic. Some international ports, for example, will completely shut down if there is a single COVID-19 infection case and will not process any ships for up to two weeks until that port is cleared. The cargo ships can also be placed into quarantine upon arrival in certain regions – no matter what goods and materials they’re transporting. When either scenario takes place, lead times are exacerbated even further.

Resource and material constraints

Railroads, air freight, and ground transportation are also seeing impacts and delays. Recently, railway workers and community members alike, for instance, went on strike to protest working conditions and expansion plans. This created a domino effect that prevented trains across the U.S. from staying on schedule and caused a backlog of containers sitting in ports while ships were waiting at sea to unload. These are the continual side effects of COVID-19 and delayed material lead time that the global supply chain anticipates will need another year to see major improvements.

Increased freight costs

In addition to resource and material constraints, there are additional variables at play such as the economic lasting effects of freight costs skyrocketing in 2021. While Stem currently holds a cautious viewpoint that the global supply chain’s overall lead time should improve by 2023 for energy storage hardware, our experts also believe that freight costs may never return to pre-pandemic levels. For example, before COVID-19, shipping containers carrying a range of industry goods cost between $1,000 to $2,000 shipping from China to Long Beach, California. In 2021, the cost peaked at $20,000. Current costs are hovering around $16,000 to $17,000 per container, and carriers are continuing to see that companies are willing to pay that rate in order to continue their business operations as usual. Stem suspects rates will begin to level in 2023 and at a minimum return to single digit values.

Government incentive impacts

When national and international governments introduce new incentive policies for electric vehicles (EV), the economic impacts tend to have upstream side effects on supply and demand. Look what happened at the beginning of 2021 when China increased its incentives for EVs. This caused EV demand to surge in China (who consumes half the global EVs) – causing an increased global demand for lithium ion batteries, the same batteries that we use in stationary energy storage. This China EV incentive along with the continued demand growth for EVs in Europe affected battery supply globally for all of 2021.

In the U.S., history may repeat itself when Ford Motor Company starts producing the all-electric F-150 Lightning this spring – the F-series has been America’s best selling vehicle for decades. Combine that with Tesla’s popular EV offering and the pending Federal Standalone Storage ITC and we will most likely see a significant increase in demand for energy storage in the U.S. throughout 2022.

Benefits of partnering with Stem

Stem’s supply chain team confidently states that there is an available supply of energy storage batteries – no purchase order placed by Stem has been rejected due to unavailability of supply. The availability of energy storage batteries that Stem has access to is associated with three factors: diversification of battery cell and storage system vendors, being one of the largest buyers of storage systems, and having the experience of procuring 950+ systems operating or contracted across 8 different suppliers. Stem’s project developers, solar EPCs, distributors, IPPs, asset owner partners, energy efficiency professionals, electrical contractors, and customers can rest assured they do have the best access to batteries at all times.

Vetted Energy Storage Systems from top tier OEMs

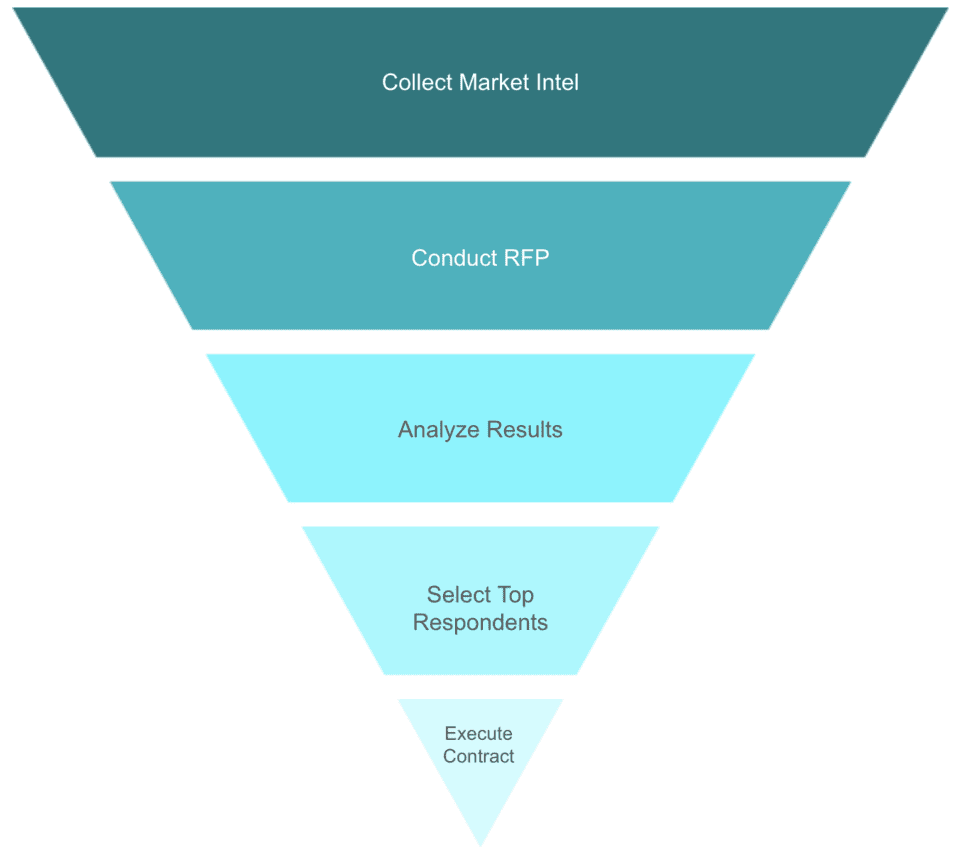

Stem’s expert supply chain team does the research and contract negotiations on behalf of our partners on an annual basis. The process begins with collecting market intel, then moves on to a formal RFP evaluation process, leading to the selection of a vendor and execution of supply agreements. The below chart showcases the process with the size of the row indicating the number of vendors included in the phase.

In addition to the annual formal evaluation process, Stem also evaluates new battery storage OEMs on behalf of our partners. We pride ourselves in being industry experts and would be more than happy to evaluate a vendor that you believe has the qualifications for your project.

By Stem performing this rigorous annual evaluation process, it means our partners save time, money, and resources while still maintaining access to trusted top-tier energy storage OEMs.

In addition, our supply chain handles negotiations of contracts covering terms such as service level agreements, warranties, preventative maintenance services, capacity performance guarantees, and end-of-life battery disposal. It’s like hitting the easy button.

There are approximately 10 battery OEMs worldwide that account for 75% of the energy storage market. Stem is in constant contact with these suppliers and has or is currently working with the majority.

Better lifetime project support and system management

Regularly evaluating battery storage OEMs puts Stem ahead of the market in knowing which suppliers are meeting the industry’s needs at a technical level and are offering competitive prices for their solutions. After negotiating and executing contracts with the majority of tier-one vendors, Stem’s team knows what terms are competitive and which product attributes are critical in solution offerings. As a result, Stem partners can rely on that expertise and can expect premier service agreements and contract terms from energy storage OEMs as well.

At any given time, Stem has at least three top-tier energy storage OEMs and can provide off-the-shelf battery storage offerings, saving a partner anywhere from three to six months of contract negotiation with the supplier.

Deployment expertise and expert warranty administration

In addition to providing supply chain benefits, Stem also brings more value in deploying and installing batteries. Stem’s Deployment and Product teams provide a myriad of lifecycle support services, including: site walks, technical evaluations, designing consultations, EPC storage system implementation training, project support, interconnection and permitting support, and more. Our Network Operations team provides 24/7 lifetime system monitoring and repair support as well as OEM maintenance management and warranty claim support. Stem works with the battery OEM for a root cause analysis, and then proactively solves the issue to ensure all customers are up and running.

Program operations and reporting

Perhaps one of our most valuable offerings is the operations and financial optimization of the battery storage system, whether it be paired with solar or standalone. Stem’s Athena software – coupled with our Program Operations team’s oversight – ensures that systems are performing at an optimal level. Our team also ensures compliance with local, state, and federal incentive programs and are conforming to the operating rules of the ISO energy, ancillary, and capacity markets. Finally, our team provides reporting on the performance of the systems and compliance to the associated programs.

Join our Stem Channel Partner Program

As part of the Stem Channel Partner Program, our professional services also keep partners up-to-date on industry trends and how we can help increase revenue. When you partner with Stem overall, it’s not just the buying of the equipment where Stem is helpful, it’s also the support and the service over the life of the partnership.

Complete the Let’s Talk form below to learn more about procuring energy storage with Stem.